The Impact of Online Accounting and Bookkeeping Services for Small Businesses in Singapore: A Comprehensive Analysis

The Impact of Online Accounting and Bookkeeping Services for Small Businesses in Singapore:

A Comprehensive Analysis Small businesses in Singapore are increasingly acquiring the services of online accounting and bookkeeping agencies.

The continued growth of this outsourced service shows that the digital transformation in accounting shows no signs of slowing down, primarily because smaller-scale businesses are finding it challenging to manually account for growing volumes of business transactions while juggling other business activities at the same time.

Not only do popular accounting software streamline many tedious and error-prone accounting functions, but they also create opportunities for integrating large chunks of a company’s financial data with related computing software residing within the same system to gain unique insights into firm operations. As a result, the accounting and bookkeeping practices of small businesses are transforming.

Considering the value of timely, accurate, and meaningful financial information, small businesses typically struggle to manage their accounts and finances.

Manually handling accounts can be a tedious task for a small entrepreneur, especially when one must wear other hats that come with the territory of being a small business owner.

In exploring these online accounting and bookkeeping services, the aim is to inform the small business owner of the pros and cons associated with bringing on such a service.

By looking deeper into these services, we seek to enable current and future small business owners to make informed choices about whether to consider their next steps in embracing such emerging services.

Watershore provides accounting services for small business Singapore for all industries.

Background of Online Accounting and Bookkeeping Services

The origins of accounting date back to ancient civilizations within the empires of the Inca, Sumerians, and Egyptians, which transitioned as businesses began to form, thus providing an opportunity for accounting to evolve.

Subsequently, double-entry bookkeeping was the next significant development, eventuated by an Italian monk. This set of principles and practices has been the foundation for the task of accounting for hundreds of years.

Today, within the context of accounting and bookkeeping alike, such services have been redesigned before entering the market in online formats, rather than brick-and-mortar structures as previously.

This technological advancement has meant that not only can accounting systems capture information in real time, but so can the software that replicates these systems.

It is these technological advancements and innovations within ergonomics and informatics that have facilitated the rapid expansion of online accounting and bookkeeping services over the past decade.

Although traditional accreditations are still needed for industry professionals, it has been found recently that a growing trend towards online solutions is being adopted by business owners and managers.

Comparing paper-based pencil and ledger accounting methods to today’s cutting-edge cloud-based accounting platforms, there are stark advantages to consider.

The seamless ability for intra- and interconnectivity of platforms has located a multitude of benefits for small owner-operated entities within the reflections of previously conducted studies.

Flexibility and accessibility of cloud-based software and platform solutions for financial information are both reliable and secure while gaining popularity with clients.

This growing movement, however, is not being witnessed without limitation, particularly in the small microenterprise sector between 2015 and 2020. In light of this, we recognized the need for further investigation.

Foreshadowing our findings, we were surprised to see the lack of exploration surrounding the critically important role of accounting and bookkeeping services for the improvement of small business finances.

As a country, we have major issues threatening successful business, predominantly the high cost of living, the pandemic, and government regulations.

Significance of Accounting Services for Small Businesses in Singapore

Given the state of small and medium-sized enterprises (SMEs) worldwide and their contribution to economic development and employment, the importance of this sector is undebatable.

It is well known that investing in the digitization of accounting and bookkeeping processes will change and boost the way companies do business.

Nonetheless, numerous explanations should be considered when investing in accounting for SMEs in order to flourish.

The necessity of an explanation for the fundamental service is crucial since it influences the recognition and understanding of the significance of accounting for small businesses.

There is no need to argue the significance of accounting in business success. The key to long-term success and growth is proper bookkeeping and accounting.

Profit, balance sheets, cash flow, and income may all be tracked and assimilated from efficient accounting.

To restore the financial state of an organization, you must first evaluate whether the company is making a profit or a loss.

You will have a clear understanding of your company’s finances and make well-informed decisions when you have a thorough understanding of the accounting services you can provide.

Every operation should comply with the rules and regulations. It is mandatory for all organizations to keep a clear and up-to-date book of accounts and to file accurate returns.

In exchange for data analysis, businesses that utilize cloud-based accounting services will observe their business’s future performance.

Based on current industry data and trends, these applications can generate projections for the next three to five years. This is possible due to the fact that there is a real-time view of the company’s financial position at any given time.

Key Features of Online Accounting and Bookkeeping Services

Small business stakeholders desire to have a real-time look in on their business. The technology exists where accountants and business owners can share the same financial files – no matter where they are in the world.

This shared access allows accountants to go in and adjust data so the small business owner doesn’t have to, allowing them to focus on growing the business.

More importantly, accountants can provide real-time tax advice and financial assessments to that business owner.

Small businesses couldn’t afford this type of service in the past as it was too time-consuming. It was also too difficult, time-consuming, and error-prone to share information.

The technology enabling real-time data access also enables user-friendly read/write data access and entry, real-time collaboration between accountants and business owners, and it is mobile.

The appeal of mobile capability is often exaggerated by accounting and bookkeeping software companies. The reality remains that almost all businesses are operated from a desktop – accounting firms are no exception.

However, a completely mobile environment may make access to other systems mobile, reducing the small business’s need for other support and business systems mobility.

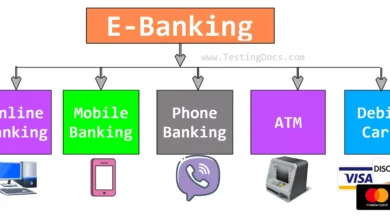

The accounting software now allows for easy import of other financial software programs – including banking data feeds – providing a much more complete small business financial environment.

Accounting and bookkeeping software has come so far in the ability to notify you when you miss financial resolutions – or when your VAT is due. It even allows you to notify your finance clients of the same issue.

Today’s online accounting software solutions are very accommodating to small businesses. Not only are they easy to leave, but they are ready for you when you are going to grow.

If you don’t need order processing, inventory, and manufacturing, and your employees can record their own daily error-free time into the payroll system, then you are the type of person that is a good fit for this type of internet software.

The best thing about these systems is they never break, they won’t crash when improperly closed, they are secure, and completely transparent.

In other words, your accountant can easily roll up their sleeves and jump into the daily transaction process without any interference. They can easily do data entry without duplicating any efforts from you.

These systems are easily adaptable to your business and personal life changes. You can add your spouse or child to post a few entries.

Automation and Efficiency

One of the hallmark features of online accounting and bookkeeping services lies in automation.

The functionality and capability of these solutions allow for the automatic execution of several accounting and bookkeeping processes, reducing or eliminating the manual workload in completing these tasks.

Examples of processes that can be automated using online accounting solutions include generating and sending invoices, recording and categorizing transactions, and generating cash flow and profit and loss reports.

This is essential in ensuring the accuracy and integrity of financial reports and accounts, as manual handling can introduce the risk of human error, especially when the volume of transactions is high.

Through automating such functions, online accounting and bookkeeping services do more than just provide efficiency; they bolster an owner’s internal control system, which not only aids in regulatory compliance but ensures that more reliable data is available to make business decisions.

The process of proposing and clearing transactions works best when activities are synchronized, repetitive, and approachable.

This is due to the mutual understanding that the person doing the work knows the details and requirements of the business.

The details and requirements for issuing checks or incoming checks to be received must be verified and approved by the person who organized the transactions.

This is where online accounting services play a vital role, as services are integrated along with predictive insights.

In order to provide business leaders with trusted data and information, accounting and bookkeeping support makes use of the necessary advances in artificial intelligence and machine learning in conjunction with predictive insights to build the automation of system close activities.

The analytics conducted recently indicate that for SMBs and not-for-profit companies, they are able to conduct their financial activities more economically each month, with an average of 88 percent savings and 250 hours of account close time.

The most attractive features of online accounting systems are their relatively lower costs, user-friendly setup, deployment, and maintenance. An average of 10 minutes or fewer to complete regular backlog of activities is the result for about 88 percent of those surveyed.

This makes it possible for small company owners and workers to concentrate on developing their business and establishing clearer guidelines more rapidly.

Benefits of Utilizing Online Accounting Services

There are various benefits to using online accounting and bookkeeping services. It offers real-time insights into a business’s financial standing and provides timely strategic decision-making.

Because of the accessible data, crucial decisions can be made at any moment and from any location.

The service is intended to transform the finance and accounting management scenario, automating the accounting and bookkeeping aspects of day-to-day business.

It also provides financial professionals with a real-time view of their company’s financial condition and reporting, giving them greater forecasting and budgeting capabilities.

Additionally, it offers a cash predictor, which allows business owners to monitor their company’s financial health through timely invoicing. An example of online services facilitating time savings is a priority for businesses.