Auditing plays a vital role in enhancing an organisation’s productivity and performance. It identifies potential risks enabling companies to take timely action to mitigate the issues. The internal and external audits are two broad categories of audits that frequently examine the company to ensure compliance. Talking about internal audits works to solve future concerns. It is one of the most effective strategies that see if the company is operating effectively or not. Like any other strategy or technique with pros and cons, internal audit problems often come to the surface, creating hurdles in the smooth process.

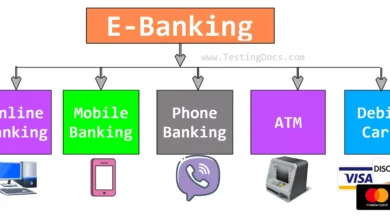

Since digitalisation has become an integral part of the rapidly advancing world, organisations are moving towards adopting technical solutions by automating all the processes. It even includes auditing. At first, companies used to follow the traditional, paper-based system that utilised major of the time. It was a time-consuming and difficult process that lasted for weeks or months. Further, even once auditors completed documenting, managing it became challenging. Companies then introduced an audit app that made the entire process faster and more reliable. Since there is an easier way of conducting audits, more organisations involve themselves in auditing their businesses, ensuring compliance throughout the process.

What is an Internal Audit?

The internal audit focuses on the examination of all the critical operations of a company, usually done by an internal auditor who is an employee of the same company. This auditor observes and evaluates finances, risk management, internal operations, accounts, controls and other aspects of the company. However, unlike the external audit, it is recurring and happens daily, weekly, monthly or quarterly. Many people refer to it as a continuous or never-ending process. It has more benefits than external audits. But like every coin or fact has two sides, the internal audit problems too come with advantages.

Auditing has become a part of the business model without which businesses cannot achieve success or cannot reach their full potential. Therefore, all the industries ranging from healthcare, automobile, restaurants to retail, conduct regular audits to keep a check and balance on correct operations implementation and the company is meeting the rules and regulations. The auditors are independent of the functions and pay complete attention to the company’s evaluation and later report it to the higher management, including the senior managers or Board of Directors.

Benefits of Internal Audits

The auditing app has made things easier, allowing auditors to examine the company’s operations remotely efficiently. What could get better than creating customised checklists, templates and dashboards according to the structure of each company? It improves the accuracy, leading to auditors accurately analysing the system to detect risks and take proactive action. Here are some of the benefits of an Internal Audit.

-

Effective Management

The internal audit problems may be many, but its advantages outdo every other thing. One of the biggest advantages of an internal audit had to be effective management. It is because the internal auditors can examine and point out the weaknesses and strengths of an organisation while evaluating its internal controls. It leverages them with in-depth insights into the process to make changes and help achieve goals quickly.

-

Performance Review

The best way to earn profits and improve performance is by frequently reviewing the business model. This means the auditor doesn’t need to wait until the end of the year to examine a company’s productivity. It can frequently do it, reviewing in real-time to take action. It helps identify the correct path and change the course of action to correct the mistakes, reducing the impact of errors.

-

Staff Performance

When a company regularly audits, the employees become more attentive and strive to get the work done more efficiently. They are more active and spend time evaluating their actions, leading to fewer mistakes. The fear of being audited or caught by auditors improves their overall performance. Hence, decreasing the chances of fraud. However, it may be an encouragement initiative for some, making employees perform well and increasing honesty.

-

Resources

One of the main aims of companies has always been to make the most out of their resources. This means optimising the use of resources to the fullest. Furthermore, it points out the grey areas of a company where the resources are being underutilised or wasted, letting companies focus on taking corrective action by using minimum resources to boost performance at cost-effective prices. Thus, decreasing the overall cost for the organisation.

-

Labor Division

Getting work completed on time requires every employee to work equally well, focusing on their tasks. It starts with dividing labour equally on each task. Here it becomes necessary to keep a strict check and balance on the system. It helps auditors observe all departments to ensure all tasks are being completed on time by the employees.

-

Instant report

The audit app leverages auditors and companies with instant report generation to take timely action and decrease the impact of errors or mistakes. It is done by assigning tasks to the concerned department or person after an error is detected.

-

Proof

One of the biggest advantages of an internal audit app has to be its new feature that allows auditors to add multiple pictures or videos with the report as proof. These get seen and evaluated by higher management. Besides this, the digital signatures need to leverage the senior managers to sign the reports for approval.

Disadvantages of Internal Audit

As we have discussed, with advantages come disadvantages, and internal audit is becoming an increasing concern for many companies. This is due to fewer qualified auditors. Since the internal auditors are employees of a company, they do not have the required knowledge, skills and experience to conduct fair and efficient audits. Moreover, these audits cannot begin until the accounting process is completed. Since an internal audit does not publish its findings, it becomes difficult for them to identify mistakes in the financial statement. Auditors forward it to the higher management that often does not take corrective action on time, leading to inaccuracy or losses in the long term.

Internal audits can make or break a company’s reputation by evaluating and taking proper measures against the identified risks. Many companies go in significant losses because of ignoring the findings, not knowing it affects the company later on. However, since the benefits are more powerful than internal audit problems, it has become critical for all organisational models.