How to stay safe when using mobile banking apps

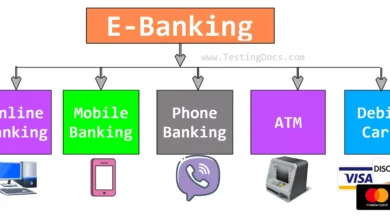

A mobile banking app is the best way to manage your funds if you have an active mobile lifestyle. Because it is so easy to handle and monitor your finances, digital banking is growing in popularity. The way you use the bank has changed due to online banking.

On your smartphone, during data transfer, and at your bank’s server, banking apps give hackers three entry points to your most private and sensitive information.

Although banks have made major advances in financial cybersecurity, there are still several methods for you to help keep your most important data as secure as possible when using digital banking. Let’s see how to stay safe when using mobile banking apps:

Secure your device

While viruses and hackers can be a severe threat to the security of your smartphone, there is also some risk associated with the device getting into the wrong hands. To begin with, always be aware of the location of your phone.

Ensure it can only be locked with a passcode, fingerprint, or facial recognition. Log out immediately when you are finished using a mobile banking app or any other app that allows you to send or receive money.

Make sure your bank’s app is secure

You probably take it for granted, but it is still essential to confirm the security of your mobile banking app and the security precautions your bank has in place.

Most banks will use two-factor authentication, which requires two forms of login information, such as a password and passcode, fingerprint, and facial recognition, to access their website or app.

You should expect a little lock indicating that the site is secure when you log into a banking app or website. If you have any questions, you should read your bank’s online banking security rules through its website.

Enable two-factor authentication

Turn it on manually if multi-factor authentication is not enabled by default for your digital banking. An additional step, a verification email or message, is more than acceptable in light of the additional degree of security it offers. Use two-factor authentication everywhere your bank account, including the finance app, might be linked.

Practice basic data defense

The fundamentals of secure mobile banking are not specific to the financial sector. According to the FTC, if you lock your phone, back up your data, and keep the software on your devices and apps up to date, you will make it tougher for hackers to access your information.

This holds for all mobile tasks, including banking. Start by selecting secure passwords that you don’t reuse across platforms. Next, protect your personal information by downloading the official bank app rather than a fake one.

Check your balance regularly

Mobile banking apps encourage you to be cautious about suspicious activity like any other online banking method. Regularly checking your account’s balance will help you notice anything out of the ordinary, and the sooner you report anything suspicious, the sooner it can be resolved.

Bottom line

Finally, the above details are about how to stay safe when using mobile banking apps. For making the utility bill payment from the comfort of your home, use internet banking because it will make your payment easier with proof.