What are the types of digital banking?

The term digital payment refers to transactions made using various kinds of electronic mediums. These procedures do not need the payment of cash or the delivery of a cheque.

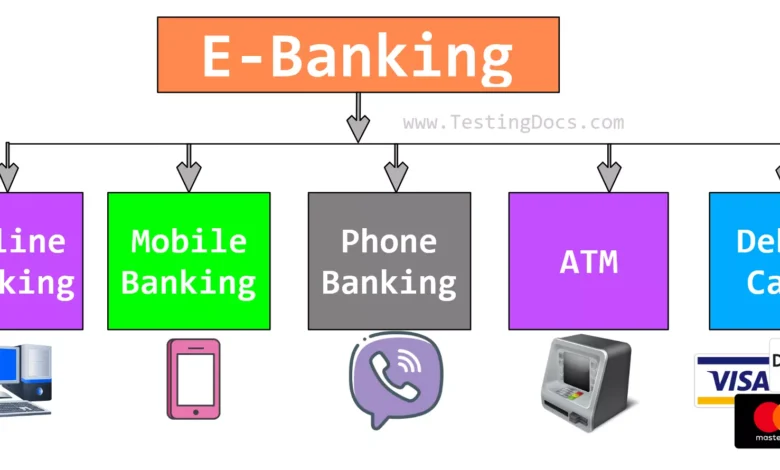

Different kinds of digital banking systems are not just changing banking in urban areas but also in the rural sector. There has been an increase in Instant Open Bank Account because of digital banking. These digital payment methods use electronic means for cash and checks. Get into detail by reading below:

Banking cards

The most popular digital payment method is banking cards. It gives customers a broad selection of features that offer convenience and security. Cards provide the flexibility of making additional digital payments.

Customers can save their credit card information in the mobile application and use it to pay for services. Banking cards (debit and credit cards) can be used for many digital transactions, such as payments in mobile apps, online transactions, and PoS terminals.

United Payment Interface

UPI is the most well-liked of the widely used digital payment formats. With just one window, you can transfer money from your bank account to the merchant using a mobile device.

For this type of digital payment, you must enter the payee’s virtual address with permission for mobile payment. One app can link many bank accounts.

Mobile banking

Through the mobile app for your bank, you can use your smartphone to access digital banking services. In recent years, mobile banking has grown in popularity along with Instant Open Bank Account. Mobile wallets are one aspect of mobile banking that has altered digital banking.

Internet banking

You can do banking transactions while relaxing in your home using a smartphone, laptop, or desktop computer with a live internet connection. Internet banking can be used for all main transaction types.

It is a common alternative for carrying out digital transactions because Internet banking services are accessible 24/7, 365 days a year.

Mobile wallets

Mobile wallets are a type of digital payment that helps users conduct various online digital transactions. The user-added funds are stored in a digital wallet connected to their bank account.

It can be used for any transaction with the use of an internet connection and an app that is downloaded to a smartphone.

Point-of-sale devices

In shops where debit and credit card payments are accepted for purchases, PoS terminals are installed. There are different types of PoS, one of which can be physical PoS, and another one is mobile PoS. Maintaining a physical device is no longer necessary because of mobile PoS.

Unstructured Supplementary Service Data

Another digital payment technique is USSD (Unstructured Supplementary Service Data). It is possible to use a mobile device to conduct cashless transactions without having to download any banking applications with USSD. The advantage of USSD is that it functions without using mobile data.

Final thoughts

In recent years, interest in Online Digital Account Opening has increased. A significant portion of the underbanked people have also been able to open online bank accounts with this technological revolution. The banking industry is moving in the right direction with digital banking features.